Investors

Residential real estate is an attractive asset class but really hard to source in a safe and scalable manner

World's largest asset class

Long-term inflation hedge

Home prices and inflation are structurally linked, resulting in high correlation.

Lower volatility

Home values have substantially lower volatility than other asset classes.

Lower correlation to other asset classes

Resilient recession performance and low correlation to other asset classes.

Owner occupied

The very definition of zero vacancy: older adults intend to age in their homes, for the rest of their lives.

Prime

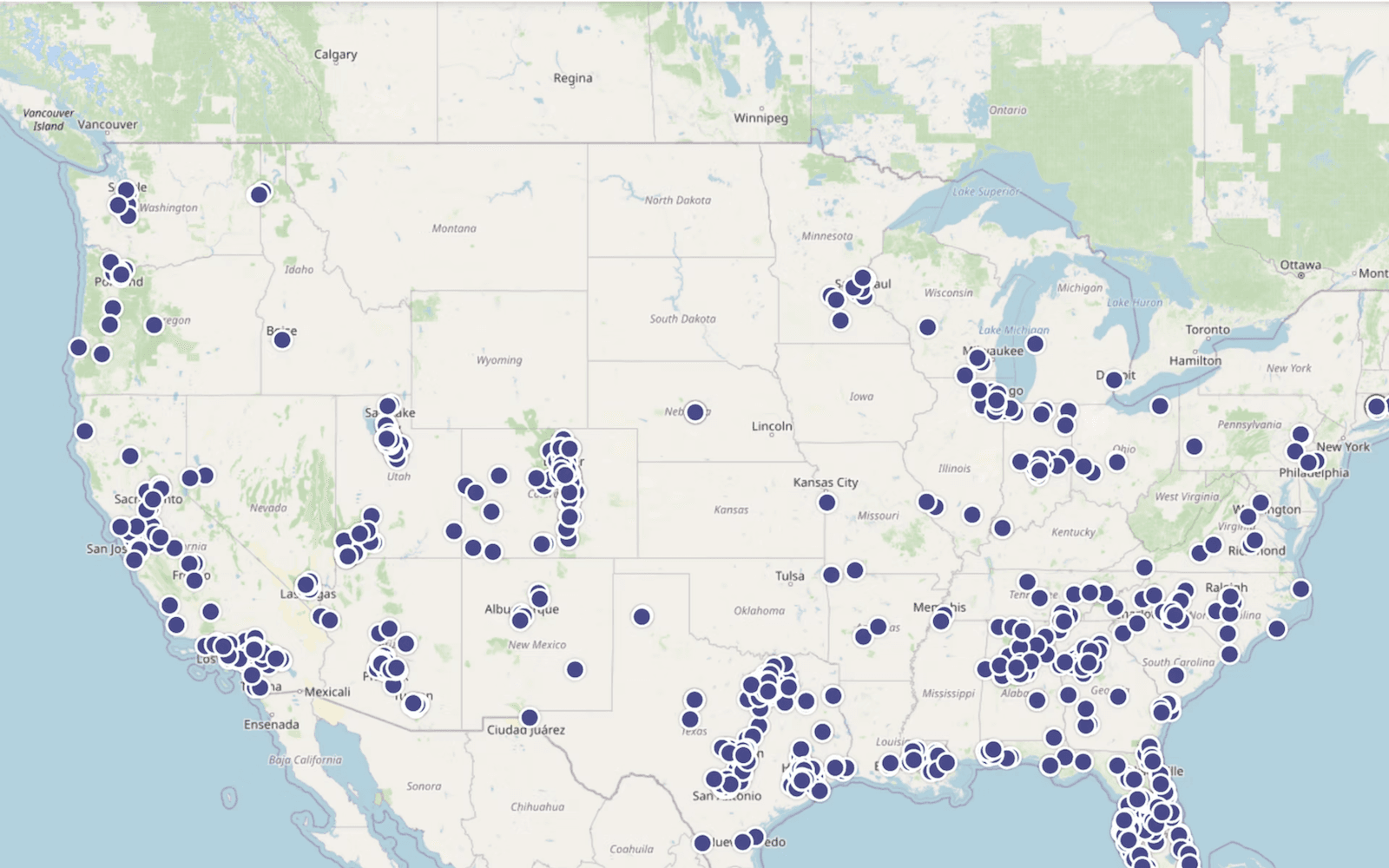

Older adults live all over the US. We can select prime areas where new builds and private equity buyers have no access, giving exposure to Home Price Appreciation.

Downside Protected

An attractive entry price point, unencumbered properties, and land value that adds to the overall investment value.

Do good and do well

People didn't plan to live longer - but they were programmed to buy a home. This new 'longevity customer' needs to de-accumulate to finance their longer lives, creating differentiated opportunity for investors.

Let's Stay Connected

Subscribe to receive our latest updates and insights.

We'll share news, helpful information, and stories that matter to you.

We care about your data. Read our privacy policy.